People have known about gold for over five thousand years. Even in ancient times, it was used as a method of payment and a measure of wealth. Today, it is primarily considered a store of value–in the form of ingots or coins as well as through jewelry. Having a small personal reserve of gold as jewelry can bring its own advantages and also be enjoyable. So, let's take a closer look at gold as a commodity.

What you will learn about in this article:

How is the price of gold determined?

The basic trading unit of gold is the troy ounce which is approximately 31 grams. The price of an ounce is quoted in US dollars because this is the basic currency of world trade. Gold bullion (also known as investment gold) comes in the highest possible purity which is 24 karats.

Where is gold traded?

There are two markets which are the most important when it comes to gold. The first is the London Bullion Market Association (LBMA) which oversees the trade in physical gold and which sets standards for gold bars. The second is the COMEX exchange in the US, where gold is traded through futures contracts, i.e., contracts for future delivery. These markets ensure that the price of gold is recognized and uniform throughout the world.

Factors affecting the price of gold

These factors are not just about the trade in gold itself. These are a number of circumstances that affect the value of gold:

-

Exchange rates: For Czech investors, the relationship between the dollar and the Czech Crown is the most important one.

-

Supply and demand: In times of economic uncertainty, interest in gold increases significantly which is in turn also reflected in its price.

-

Mining and recycling: The amount of newly mined gold and gold that is recycled back into the market.

-

Inflation and interest rates: Higher inflation often leads to an increase in the price of gold.

-

Geopolitical events: Conflicts and crises increase the demand for safe investments such as gold.

The historical price of gold

The value of gold has been rising over the long term, though it does fluctuate in the short term. Thirty years ago, a troy ounce cost approximately $395; nowadays, it is around $3,450. To give you a better idea: ten years ago, the price of gold was around €37 per gram and these days, it’s around €95. Gold is therefore considered more of a long-term investment than a means to a quick gain.

The various forms of gold bullion

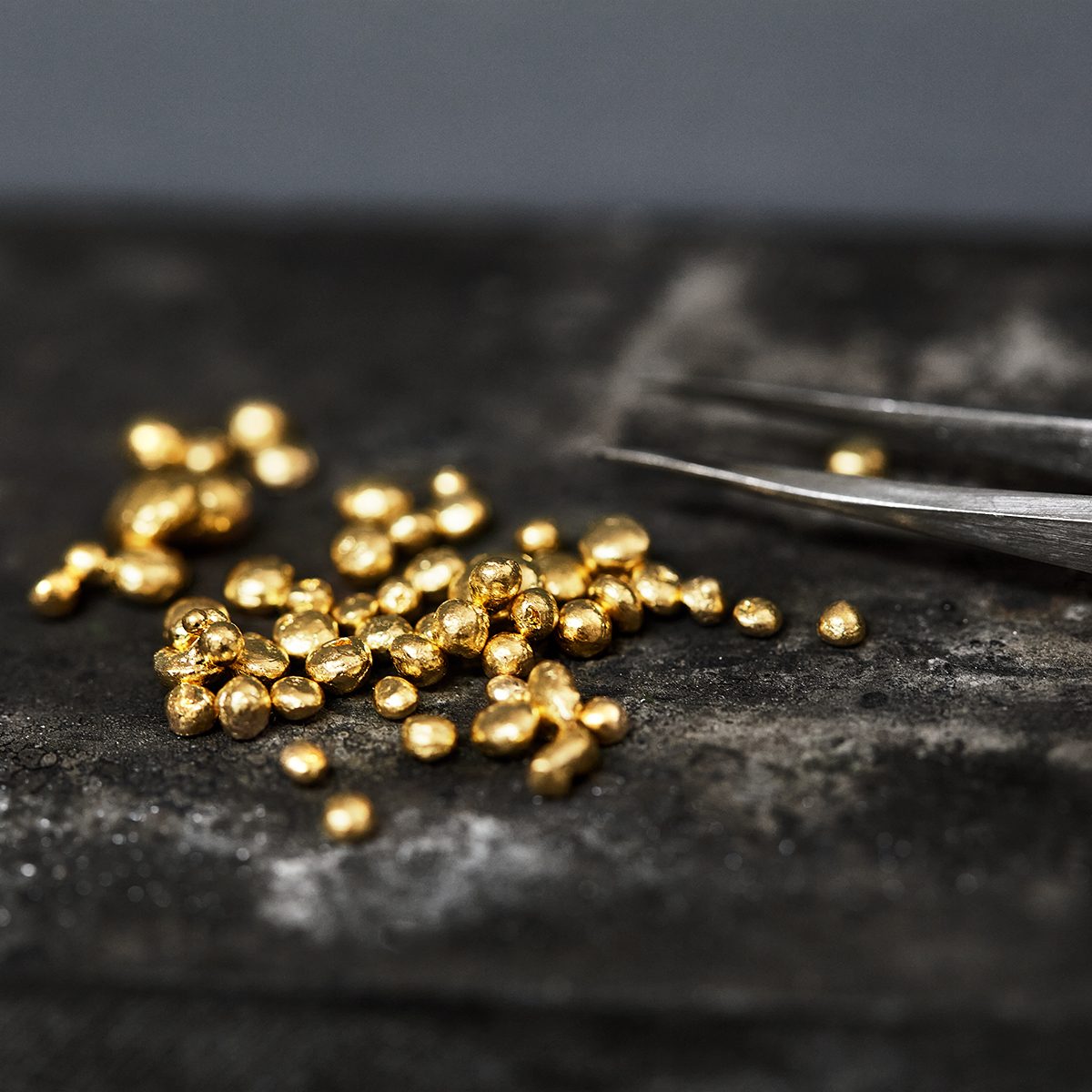

On global markets, gold is primarily traded in larger quantities, which is why gold bullion in the form of bars or ingots is mainly used for investment purposes. However, not everyone can afford such a large investment so there are also more affordable options – smaller bars or gold coins.

Gold coins are often issued as part of a themed series which also gives them value from a collector's point of view. But with these, there is a higher risk of counterfeiting. The situation is more transparent when it comes to ingots and small bars–each piece must have clearly defined parameters set out by law, such as a serial number and an exact weight. Another advantage of both coins and bars is that by law, they are exempt from VAT.

Is buying jewelry a good investment?

For those who want to invest in gold but feel a bit lost in the confusing investment market, jewelry may be a more accessible and easier option. Its price is driven primarily by an original design, artistic craftsmanship, as well as the gemstones used, which can themselves be a valuable investment that can increase the price of the jewelry. Another big advantage is its usefulness: jewelry can be worn, easily transported, and safely stored.

However, jewelry comes with certain disadvantages that are good to keep in mind when you buy it. The purity of gold used in jewelry is usually lower than in bullion, which is why its value reduces. Another risk is that it is easy to counterfeit and more complicated to resell.

How to choose a trustworthy jewelry seller

It is always better to buy jewelry from reputable jewelers, ideally those with their own workshop and jewelry that’s handcrafted. Each piece of jewelry should be stamped with a hallmark which guarantees the purity of the metal: the stamp 585 signifies 14 carat gold and 750 is for 18 carat gold. Next to the hallmark there should also be a maker’s mark and, for gold jewelry weighing more than 0.5 g, the state (national) hallmark which is done by the Assay Office.

TIP: To find out more about hallmarking, take a look at our blog article on the topic.

All the important information about the jewelry should also be in the description of it–what metal it is made of, its purity, whether it has undergone any surface treatment, as well as whether it is set with any gemstones, including the details on those. At KLENOTA, we will issue you with a certificate with your jewelry that contains all the relevant information. For jewelry purchases of larger carat weights, you will also receive a separate certificate for the gemstones. Of course, we also provide a warranty and free cleaning for the life of the jewelry.

There are also other advantages to buying from experts that are worth mentioning. In addition to the jewelry itself, you also get access to our expertise and advice when it comes to choosing the right piece. If you’re not very familiar with jewelry, it’s worth taking a bit of time to choose the right jeweler and being able to see and try on the jewelry in person is a big advantage. Visit our showroom at Dušní 6, Prague 1 so you can choose the right piece just for you.

Jewelry as a store of lasting value

Gold is a stable commodity with a long-term upward price trend. Unlike stocks, investment funds and other forms of investments, gold physically exists and is therefore a safe way to store money. Gold jewelry can be viewed as a very personal form investment that also brings with it joy and a practical purpose. No other form of investment offers this.

What is gold bullion (investment gold)?

Gold bullion is gold intended for investment in the form of bars, ingots or coins with a high degree of purity, typically 24 karats (999/1000). It is VAT-exempt and is used as a long-term form of value preservation.

What is the difference between gold bars and gold coins?

Gold bars have a precisely defined weight and purity. Gold coins, on the other hand, also hold additional value as a collector’s item due to their design and any thematic series they may be part of on top of the value of the gold itself.

What are those large gold bars in the shape of bricks?

Larger gold bars in the shape of bricks are a larger form of gold bullion and most often weigh 1 kilogram (400 troy ounces). They are mainly used for larger investments and are traded on global exchanges.

How has the price of gold developed historically?

The historical movement of the gold price shows that its value has been growing in the long term. While 30 years ago the price was around $400 per troy ounce, today it is in the thousands of dollars. It fluctuates in the short term, but it functions as a stable investment over the long term.

What is the price of gold in 2025?

The price of gold in 2025 is around €95 per gram (this figure changes daily depending on stock market and exchange rate fluctuations). To find out the current value, we recommend checking specialized exchange market charts or rates published by gold dealers.

What is the price of pure gold in 2025?

Pure gold (24 carats, 999/1000) is the highest possible purity and is traded on global markets. In 2025, the price is around $3,755 per ounce which corresponds to approximately €3 555 and this changes daily.

Is jewelry a good way to invest in gold?

Investing in jewelry can be a suitable alternative for those who want the value of gold as well as the ability to wear it. In addition to gold, the value of jewelry is also influenced by design, craftsmanship, and any gemstones in it.

What is investment jewelry?

Investment jewelry is jewelry made of good quality gold (14-karat or 18-karat), often set with precious stones, which retains its value and may even appreciate over time. In addition to its aesthetic function, it also serves as a form of personal investment.

Why buy jewelry with a certificate?

Jewelry that comes with a certificate guarantees the purity of the gold and the specific properties of any gemstones in it. The certificate is an important document of authenticity and quality which increases a buyer's confidence and the potential value when reselling the jewelry.